How to Invest As A Digital Nomad

3 Steps To Get You Started

Getting Active

Wouldn’t it be great if we could remove financial stresses and build a better future where you have the independence to choose how you want to live your life?

To do this, we need to get active in taking steps to make it happen by spending less, saving more, and not leaving the majority of our savings in cash.

One big error I made in the past was leaving too much of my savings in cash savings accounts in the bank, earning almost nothing. This was mainly because I didn’t know where to start with investing, it was too complicated, and (like most of us) I hadn’t been taught how to make it all seem too scary.

Why Invest At All?

As you may know, most banks’ savings accounts and term deposits earn less than inflation. This means that your spending power diminishes over time. For example, you might have enough money in the bank for a house deposit this year. But in ten years’ time, the money you need for a house deposit has increased.

You need to ensure your savings have grown by at least this much so that your money has the same spending power in the future.

So to those that say investing is risky, to me the biggest risk is not investing and losing money over time.

How Much Do You Need To Start?

There is a common misconception that you need a large pot of money to get started.

This is no longer the case. You can open an online account in a few hours. You can get started with no capital upfront and simply add a small monthly amount to your account.

This will give you access to a basket of investments that generally provide a rate of return above what is offered in a bank savings account.

Plus most accounts today are completely unlocked which means you can take the money out whenever you like.

Let’s walk you through the three key steps to getting up and running.

1. Start As Early As Possible

The earlier you start, the sooner (and faster) you will begin moving towards your investment goals. With compound interest, your investment will start earning on its own. Compounding allows your balance to grow quickly over time. Especially if you’re able to keep adding to your investments monthly. But, it’s also never too late. Yesterday might have been the best time to start. The second best time is now.

2. Learn The Lingo

Stocks

A stock is a share of ownership in a company. These are also known as shares or equities. They can be purchased for a share price that could range from a few cents to thousands of dollars.

Bonds

Bonds are typically lower-risk investments that are essentially a loan to a company or government in return for a rate of interest over a period of the year. Bonds, depending on your age, will usually make up a smaller percentage of your overall holdings. They are great at reducing the overall volatility of your portfolio as they are more stable than stocks. Once you get to Step Three of this guide, you can work out what percentage of your overall portfolio should be in bonds.

Mutual Funds

Mutual funds are managed by fund managers for a fee, usually for around 0.5% -1% of your total invested capital per year. For that fee, the fund manager will attempt to outperform the market by selecting a basket of stocks and bonds based on your strategy. The rate of return will reflect the performance of that fund manager. If you don’t want to worry about managing any of your holdings and let someone else do it, this is the option for you. Your money is completely unlocked you can withdraw the full balance at any time.

Exchange Traded Funds (ETFs)

ETFs hold many investments bundled together like a basket of stocks or bonds. The main difference between mutual funds and ETFs is how they are managed. For example, you can create an account online and buy into the S&P 500 ETF which is the 500 biggest companies listed in the US. Think: Apple, Google, and Tesla. This gives you access to a broad range of stocks. The ETF would track the performance of those 500 companies. If the overall share price goes up, your money goes up. If it goes down, so does your money. The benefit here is that you own 500 tiny pieces, rather than single stocks, giving you diversity in your portfolio. In my view, this is the best value option as you can buy ETFs with a fee of as little as 0.05% per year. And you get the overall return of the US market. Vanguard and Blackrock are the biggest and best for this investment type. Your money again is completely unlocked you can withdraw the full balance at any time.

3. Pick A Strategy

There is no good or bad allocation here, you just want to find the best one that matches your situation.

Now that you know about the different types, you need to get the right mix of them.

Your strategy needs to reflect your goals and objectives. This will be based on how comfortable you feel about the balance of your investments moving up and down with the market volatility. You also need to consider the length of time you want to invest.

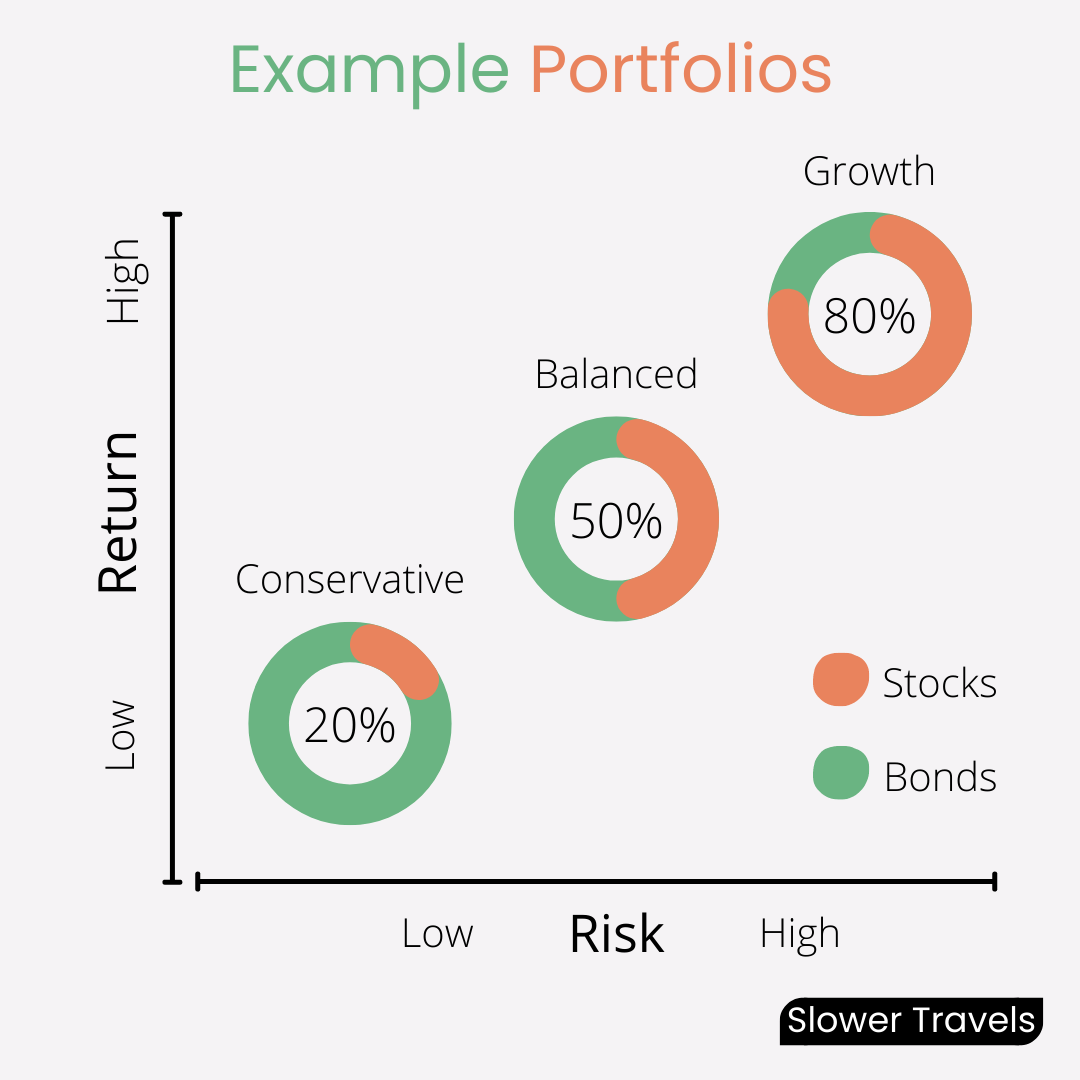

The typical allocation of funds can be labeled Conservative, Balanced, or Growth. The more conservative your strategy is, the fewer shares and more bonds you will own. With a growth portfolio, the opposite is true — you own fewer bonds and more shares. Simple right?

Your appetite for risk as well as your time frame will help decide which allocation is right for you.

For example, if your time horizon is five to seven years you would pick a suitable investment for that time frame, such as Balanced.

Over seven years, a growth portfolio is typically most appropriate. Most online platforms allow you to run through a checklist to help you pick the right strategy.

One question I used to get asked a lot as a Financial Advisor is, “I want the highest return, why can’t I go Growth even though my time horizon is short?” Of course, you can, but then you risk the stock market taking a dive and not recovering just at the moment you need to withdraw your funds.

Not a great result as you have to sell for a loss. The US stock market has recovered 100% of the time, but what we don’t know is how long that could take. That’s why you need to consider the time horizon as well as your appetite for risk to define the best strategy for you.

What’s The Best Option For You?

Of course, everyone’s circumstances are very different so get to know your options. However as I mentioned Index funds or ETFs are considered some of the smartest types of investments, and for good reason.

They include broad diversification, low costs, and attractive returns. The best bang for your buck ETF providers are Vanguard and Blackrock. Using these options means you don’t have to worry about picking individual stocks. Leave that to the experts.

One caveat: if you’re buying ETFs using an online platform, you’re on your own so you do need to do your research. There are a huge number of resources online. We’ll also be diving into this topic more, as this is my background and area of expertise. Got a specific question? Send us a message. We’d be happy to assist.

For most of us buying and holding the S&P 500 and the NASDAQ-100 Tech will be fine over the long term.

Below is a list of some providers where you can open an account that will let you buy Vanguard and Blackrock ETF funds, depending on your place of residence.

If you are US based: Sofi

If you NZ based: Sharesies

If you are UK based: Interactive Investor

Now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.