How to Build Wealth Faster

How It Works

At Slower Travels, our mission is to empower and inspire you to take control of your future and create the lifestyle you desire. To achieve this goal, we will teach you the basics of investing in a simple way that will get you on the right path. Whether you are already a digital nomad or aspire to be one, this guide will help you get there faster.

Investing doesn’t have to be complicated or sexy. It should, in fact, be very boring. Add money from your wages each month into the buckets as explained below and watch your wealth grow quickly over time.

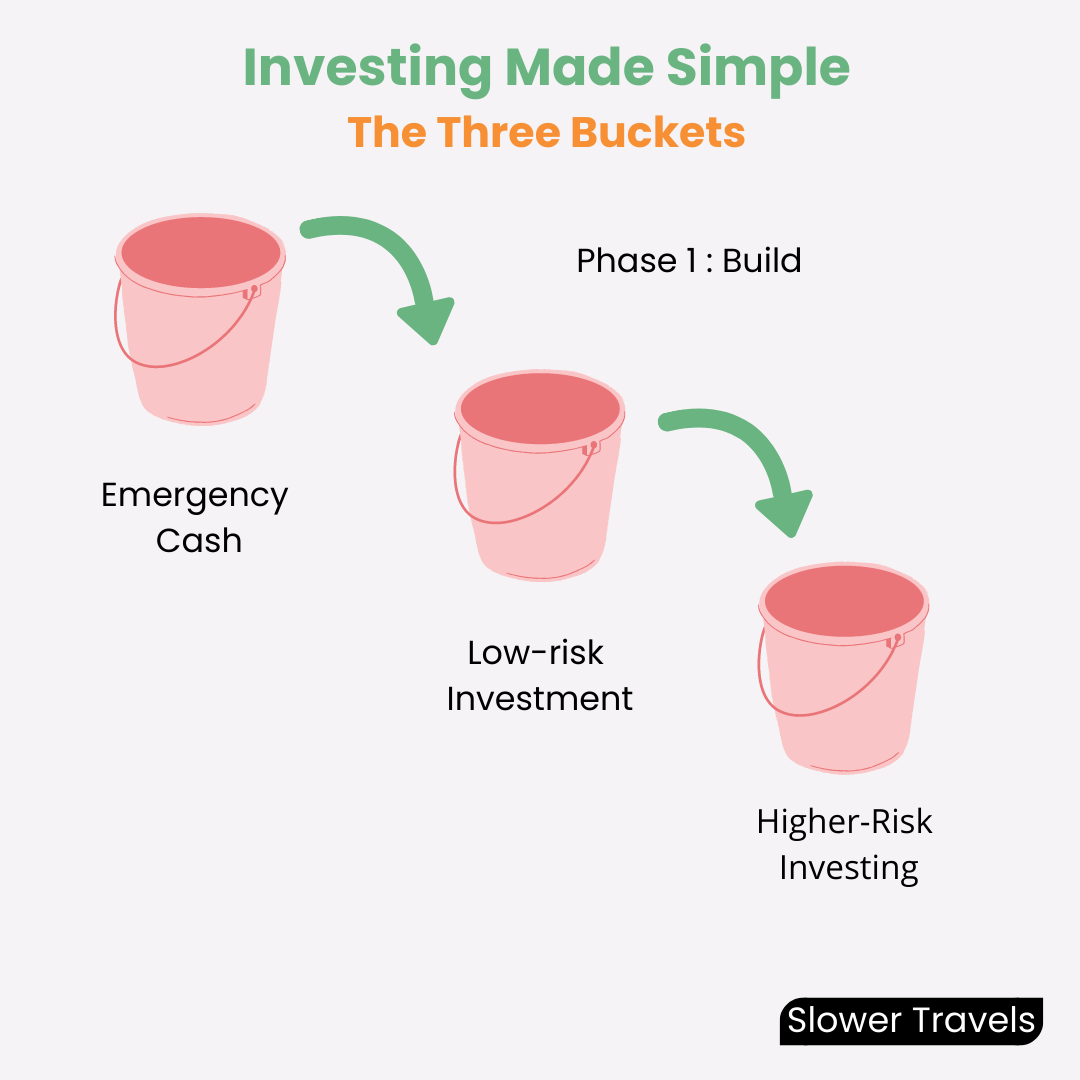

The easiest way to use your savings effectively is by using the three-bucket system. Each bucket represents a piggy bank with a different type of investment. Typically, the buckets are Cash, Term Deposits, and Stocks, each with a different level of risk. To get started, determine the amount of money to allocate to each piggy bank. Then, begin the process by paying into Bucket One first, followed by Two, and then Three.

The process to determine how much to allocate to each bucket is outlined below.

Let’s see how it works in practice.

Emergency Cash

The boring old emergency fund. Boring but essential. You need at least months’ expenses on hand to cover any unforeseen emergencies. This might sound high at first, but remember, this should only be your Needs, not your Wants and Savings. Your Needs are what you have to spend on bills to keep you going during the emergency. If you were at a place where you needed to actually dip into this, your ‘Wants’ (e.g. your fun money) would dramatically reduce, if not disappear. You would also not be saving over that period. So add up your monthly Needs and times it by three. That is the total for bucket one. If you dip into bucket one, then use bucket two to top this backup.

Low-Risk Investment

Low-risk investment bucket is bucket number two. You would usually use term deposits or very conservative mutual funds. They are lower risk and are designed for a two-year or less holding period. You will not get a high return, but it will typically be higher than cash in the bank.

What size should this bucket be? You will be using this bucket for any big-ticket items you need to buy in the next 12-24 months. For example, a deposit will be required in a few years. Or a cash purchase on a car that you want in 12 months’ time. If you don’t have any big-ticket items planned, then skip this bucket and move to bucket three. If you dip into bucket two and it requires topping up, take money from bucket three.

Higher-Risk Investing

This is the higher risk, higher reward bucket. So, index and mutual funds. This is the longest time frame piggy bank, so you want stocks and property funds in here. They typically give a higher return than cash or term deposits over the medium to longer term. This is where you will see the magic of compound interest as your money starts to earn money on its own. See our guide to getting started on this bucket. Click here to read our guide on how to invest.

Other Considerations

When starting out keep in mind that if you don’t have any big-ticket items coming up, you might not need a bucket two. But over time your circumstances will change, so something might come up on the horizon. So you’ll move funds from bucket three, into a lower-risk investment like a term deposit so they’re ready to go when the time comes. This protects the funds from any volatility that might come up just as you’re looking to spend that money.

In Summary

This is a great easy system to keep track of your progress by monitoring each bucket and making any changes required. Investing doesn’t have to be complicated or sexy. It should, in fact, be very boring. Add money from your wages each month into the buckets and watch your wealth grow over time, opening a more interesting future. Investing is not just about retirement it’s about living a better, more stress-free, goal-driven financial life ASAP. Get started!